An estimated two-thirds of mergers fail, often because the newly combined organizations do not mesh effectively. Unexpected issues frequently emerge that limit the anticipated advantages of the transaction, either in terms of business growth or cost savings. Especially with cross-border mergers and acquisitions (M&A), one of the most common issues is lack of “culture fit” between both organizational and national cultures.

Beyond the anticipated strategic fit that is the primary rationale for combining organizations, employees in the new combined entity will have many questions that need to be answered.

Mergers, acquisitions, and alliances come in a variety of forms, some of which are easier to implement than others. When a large company purchases or allies with a smaller company primarily for its technology, and both firms are from the same country, integration is usually easier. However, the integration process is likely to be far more complex and difficult when there is a merger of two larger companies with headquarters in different countries and a strategic priority to retain key talent as well as technology.

Merger and acquisition deals typically proceed through a series of phases:

Alliances go through a similar process, but the parties remain separate and they do not usually require the same degree of integration.

The first few stages—strategic planning, due diligence, and negotiations—usually focus on strategic and financial considerations. The post-transaction stages of integrating the two organizations and making the new entity sustainable over time are often neglected or shortchanged.

M&A and alliance leaders often experience cultural misunderstandings, and may unintentionally create issues by overestimating similarities and underestimating differences between themselves and employees from the new acquisition or partner. These mistaken assumptions can be exacerbated by group think. For example, it is difficult for a member of the transaction team to express fundamental doubts about the proposed deal to enthusiastic senior executives and with substantial costs already invested.

Companies generally designate an “integration team” consisting of members from one or both legacy organizations to make a transaction work. However, team members are often preoccupied with tactical challenges such as integrating payroll systems, information platforms, or suppliers, and commonly neglect the people side of integration. This can include providing clear and inspiring communications about next steps, bridging cultural differences in communication and work styles, defining the new organizational culture, supporting restructured teams, and nurturing client relationships. Employees who are suddenly questioning their job security need reassurance and guidance in order to become productive and engaged members of the new company. Small but meaningful issues such as misalignment of titles or job descriptions from the legacy companies must also be addressed—this can be a particular challenge if one culture is more hierarchical or group-oriented than the other.

There are a number of steps that M&A integration teams can take to promote healthy integration and long-term sustainability. This process requires a holistic approach that makes integration a priority rather than assuming it will occur automatically. Common integration issues that tend to arise are how to bridge differences between national cultures and teamwork among leaders.

Local cultures influence the workplace activities and preferred work styles within each company. Integrating different national cultures often starts with analyzing everyday habits. In our engagements with M&A integration teams, we have found it important to inquire and observe based on a set of key questions about the different legacy organizations:

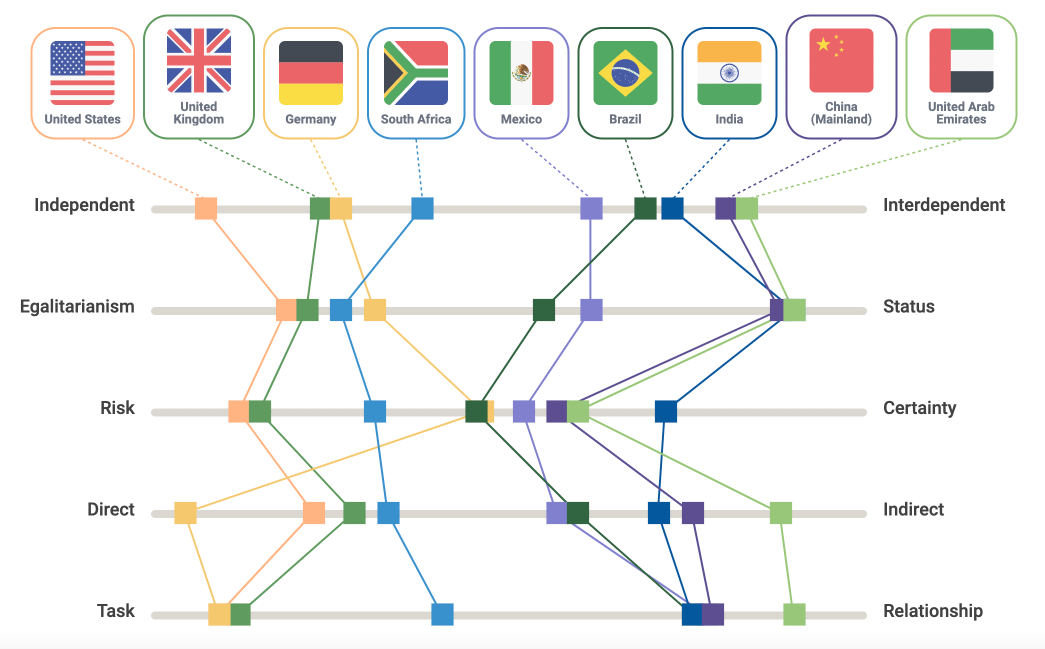

For integration to succeed, people must be aware of cultural differences and develop cultural skills such as frame-shifting or style-switching. Depending on the cultural context, decision-making styles, for example, may be more independent or more interdependent, more egalitarian or more hierarchical. Some problem-solving approaches are more risk-oriented through trial and error, while others are focused on achieving greater certainty through extensive data analysis. Communication in meetings could be more direct or indirect. Some cultural settings are more task-focused and transactional, while others value ongoing relationship-building with customers and cultivating broad social networks. Research-based cultural competence tools like the GlobeSmart® Profile can help to distill this inquiry process into structured comparisons as well as next steps for how to approach integration challenges.

In addition to coping with national cultural differences, leaders tend to have the largest stake and the most important roles within their own legacy organizational cultures because they have personally been involved in creating them and are viewed as role models by their employees.

Leaders who are unable or unwilling to adapt to an integrated organizational culture can cause teams to split into factions working toward different purposes, hindering integration or even bringing it to a complete halt. The state of an integration can be assessed based on the number of “positive” or “problem” teamwork behaviors. Positive behaviors include trust, respect, open communication, information-sharing, a focus on shared goals, and thinking together. Problem behaviors include factionalism, stereotyping, a lack of mutual understanding, hidden agendas, finger-pointing, and inflexibility.

Focused team building for executives and other business leaders is vital to build strong personal relationships and trust within the combined organization. One useful starting point is asking each person, “What would you most like to see preserved from your previous organization?” Acknowledging and, where feasible, maintaining legacy practices to which leaders have strong emotional commitments encourages everyone to avoid defensive reactions and to build “third way” solutions together.

—

Download our latest white paper to learn even more about ensuring successful mergers, acquisitions, and alliances.